Intro

The Game is the Game. Always. (Avon Barksdale / Marlo Stanfield, The Wire)

Some things change and some things stay the same in the tech industry. The two major themes I’ve seen the past few years in tech are:

- High interest rates to combat inflation after the pandemic and the resulting impact on the economy and tech industry.

- Cryptocurrency, GenAI and the next land grab.

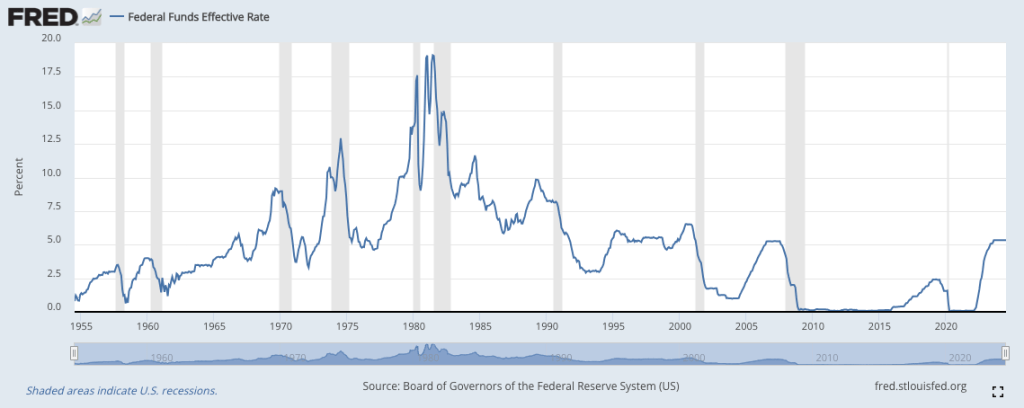

High Interest Rates

For some background to the chart above, we’re effectively paying the pied piper for the pandemic economy on inflation (blog post) – but really it goes back further than that. The Fed‘s interest rates have been really low (~0) since late 2008, and now they are back at 5% to combat inflation. What this means is that money was incredibly cheap for about 14 years (2009 – 2022). A lot of that money went into tech investments: startups from venture capitalists, and valuations from high growth tech stocks post IPO, etc. With cheap money, we saw tech companies spending a LOT of money on customer acquisitions/growth and effectively venture capital-subsidized services (e.g. Uber, Doordash, Airbnb, etc) with a few wild scammy companies blowing up in the hype (WeWork, Theranos, FTX) through this tech bubble. Many of these companies weren’t/aren’t profitable, but the idea was that they’ll eventually get a monopoly and dominate like Google, Facebook, Amazon, etc (blog post on colonized attention). Stocks became more about growth than revenue, and IPOs were often seen as a way for startup employees to cash out, rather than a legitimate call for more investment from the public to continue to grow (i.e. venture capitalists don’t need to create a productive business, they just need to have something like a pseudo ponzi scheme to build hype and sell their shares at IPO). This is me being a bit cynical / glass half empty (as many of these companies created a lot of value), but regardless, when money is cheap people get addicted and valuations skyrocket (i.e. Unicorns become common).

You fell victim to one of the classic blunders! The most famous of which is, ‘never get involved in a land war in Asia’ (Vizzini, The Princess Bride)

There is a lot of betting going on at the venture capital/large shareholder level. And there have been a few major land grabs for tech following 2 major booms of internet technology: the 2000s dot-com boom (websites) and the ~2010s boom in mobile internet due to the rise in popularity of smartphones (apps). As the old saying goes: “During a gold rush, sell shovels” – the real, reliable power was in platforms, not products. Why risk making an expensive, unsuccessful app when you can just own the app store and charge a fee? So the strategy was to make your own platform (e.g. Google’s Play Store, Apples App Store and hardware, AWS, etc).

Crypto

During the last major tech ‘hyper’ bubbly bubble from cheap money right around the end of the pandemic (2020-21), we saw the focus move from apps to speculative cryptocurrencies. Their premise was that there could be a decentralized internet currency independent of governments. Regardless of any good intentions, it turns out that for now people trust the US dollar/central bank (Federal Reserve) more than the internet/blockchain for their actual money. The hype was strong, but IMO was coming more from greed around the cheap money environment and trying to escape from the dire economic (and emotional IMO) situation of the pandemic. But who knows – some aspects of crypto might stick around/add real value – but I personally think/hope the peak has passed (I don’t own any crypto). Cheap money is addictive, a whole generation grew up with it, but some people putting their life savings into crypto was pretty wild (even worse than r/wallstreetbets). Even now, some Silicon Valley VCs and CEOs (e.g. Andreessen Horowitz, Peter Theil, Elon Musk) have even decided to abandon any veneer of ethics and turn to supporting Trump in part to keep the hype train going, to ensure their returns on their crypto investments (and of course, pay less taxes on their unsold stocks) – because they want de-regulation and perhaps destabilization, making crypto a better option/alternative (as well as just never to pay taxes). Their money gives them immense influence, seen in the VP pick of JD Vance and perhaps rising bitcoin prices.

Granted, I would argue that most reasonable people who didn’t stake their reputations and financial future on crypto have mostly moved on for now. Yes – some parts of a decentralized currency for the world seemed nice, but it didn’t happen – scammers took over faster, and it started to seem like the people who wanted crypto to replace the dollar happen to all own a lot of crypto… they didn’t want to escape central banks, they wanted to become the central banks. There were/are definitely elements of pyramid schemes for a lot of coins out there and some rich folks who didn’t want to be bag holders or look foolish.

In the end however, inflation was getting too high in late 2021, so the Fed raised rates to combat it, and the bubble burst (and crypto failed to realize it’s potential and become a better alternative, at least for now). This means a generation of tech workers suddenly getting faced with a new environment of economic hardship and a changing climate (i.e. layoffs, fewer job opportunities, more fear/job insecurity, etc). While some people keep waiting for interest rates to drop, ultimately 2008-2022 was more of an anomaly than how things are today. There are ways to stay sharp, but realistically things have just slowed from the ‘car driving 100mph gold rush era of tech.’ Except of course… for GenAI.

Generative AI

A lot of people who were too skeptical to fully fall down the crypto rabbit hole are suddenly seeing GenAI as that next wave of disruptive technology to jump to. ChatGPT for example, was the first time I personally felt that AI had reached a place where it became practical to everyone. By that, I mean it could fool the average person pretty cheaply and in a scalable way. My first thought was that it’s gonna make internet propaganda/misinformation much easier – and might ruin major parts of the internet. Maybe it will – but it’s undeniable that GenAI has changed the game and has a level of practical use that I never saw with crypto.

Right now, there is a major tech land grab for who gets to be the default LLM, similar to the search engine and default browser wars (both won by Google), or the rush to be the most popular crypto (Bitcoin). OpenAI has the lead, but it’s anyone’s game, resulting in a lot of VC funding around AI due to FOMO. I’d argue ChatGPT is just a better, more conversational and personalized Google – where you can ask it to write code or a paper instead of finding resources and doing the mindless task of creating a baseline template yourself. Meanwhile, enshittification has caught up with Google search – which kind of sucks now (I think this is just a part of some tech product lifecycles: eventually they get bad if not actively protected).

There is no silver bullet that’s going to fix that. No, we are going to have to use a lot of lead bullets. (Bill Turpin…. a16z)

For workers, the world is more competitive with higher interest rates – since there is literally less money going around (part of why it works to stop inflation). This affects the tech industry via fewer job opportunities and less job security (layoff risk). ChatGPT can help get some workable code quickly or write a tailored cover letter easily – but the real challenge is implementing production code successfully or passing behavioral interviews – the part that actually matters. ChatGPT has created a lot more noise for recruiting (e.g. cover letters written by GenAI) – but honestly that’s not a problem as long as interviewers are telling the truth. After all, interviews are all a hedge against risk (i.e. the risk of hiring someone random who is unqualified), which a good interview process will help with filter out (hopefully not by creating a dozen rounds of interviews….).

Being proficient with GenAI, similar to knowing a lot of people, can help get you the meeting, but you have to actually have something of value to close the deal. That could be the right skill set or experience, but there must be something substantive. Similarly, people can get stuck in an internet rabbit hole with AI – but they still have to deal with real people in the real world to survive. Those skills, like taking care of your own mental health, cannot truly be automated.

AI won’t take your job, it’s somebody using AI that will take your job. – Richard Baldwin

GenAI can be a very useful tool in a lot of situations, but someone still has to leverage that tool effectively to add something of value. ChatGPT can write the draft, but you have to turn it in for evaluation, which means you still need to actually earn trust. A more competitive economic environment doesn’t means jobs aren’t out there – it just might take more work to get them. For example, one valuable skill is being able to distinguish hype from lasting value – the rest is often just luck.

Technologies are always changing and evolving, even if you knew all of them right now, new ones would develop soon after. For example, once you learn one coding language, it is easier to learn another one. But even more important, was having someone to mentor, teach, and sponsor you initially.

Working in Tech

So, why am I telling you? Because you are part of my network. I am not trying to become a writer/influencer. I am writing because I like it and I want my network to be strong (in their minds, bodies, careers, and relationships). Similarly, I want a life of real value, not random hype bubbles. I don’t want to develop that addictive pattern (it’s why I didn’t ever buy crypto – I didn’t want to be addicted to following a speculative value). I want to work on a team with aligned principles.

One principles I’ve developed for where I want to work in tech is that the business is (1) practical / a clear monetization strategy, and (2) solving an actual problem – not creating artificial value. For my current company (Square), the root premise of the company is allowing people with smartphones to process credit cards / participate in commerce and not lose a sale since someone lacks a check or enough cash. It is hardware & software, built off the platform of smartphones / mobile internet (though it’s expanded a lot since, it’s core principles is economic empowerment). At my last company (SoFi), the main value was re-financing student loans at rates lower than the government at ~6.8% (if I remember right). This was also somewhat built off of the low interest rate world – and more of a financial company than tech – but I learned a lot of data career skills there. Before that (my first job after college) I was working at the Federal Reserve in DC in the macroeconomic inflation forecasting group (more relevant to today than it was when I was there in 2013) – where the value was, in a small way, helping US macroeconomic stability in the aftermath recovery of the 2008 recession.

Or, at least that’s the story I tell myself. It takes effort to create meaning. It takes work to connect my story to a purpose. The real reason I took those jobs were:

- The Fed – I needed a job after college and could get it from my economic research background. Also a friend of mine from college worked there.

- SoFi – I moved to California so my spouse could run a local fashion jewelry store and it was nearby / was hiring a lot after they raised $1B from softbank… Also my Aunt’s friend worked there and referred me.

- Square – I wanted to move to the Bay Area proper and work at a place where I felt less trapped by geography (ie there were companies nearby I could work at in the city, and I could get a foot in the door/information about other tech companies from former coworkers). Also, an alumni from my college worked there.

A lot of this was luck and timing and my network. Careers are tough, and long – sometimes filled with frustration and disappointment. And sometimes the big choices are easier because of timing and everything aligning, and sometimes the smaller, ambiguous choices (and waiting), are actually the harder parts. The tech bubble(s) resulted in a lot of people working in tech for the money who maybe wouldn’t have otherwise. The bubble bursting is a tough situation for many, and a good time to re-evaluate what matters most. There is real value in a lot of companies out there, even if they are hyped up / bloated somewhat (e.g. Patreon, Snowflake, Discord, Plaid, Stripe, Shopify, etc to name a few I like). It’s helpful to know what is actually important in my life and career. And for me, it’s achieving and learning with the people around me (being on a strong, purpose-driven team), financial stability for my family, working in a space that ideally adds some value for the world, that I enjoy most of the time.

If you are reading this, you are likely in my network directly or indirectly. And if you are interested in tech, early/mid-career career, or are just struggling in the job search – reach out! Either to me or whoever you know in my network, even to just check in and say hi. Maybe I can help connect you or if you know me, be a sounding board. A career in tech, despite the hype cycles, is still a marathon, not a sprint. It’s weird times, but ultimately mind, body, community, relationship & financial health is all the really matters to me to sustain. I don’t want to work at a business I don’t think adds value to the world somehow, or actively makes it worse, but just having income to live a life I want is very meaningful to me. I’d like to help others do so however I can, and maybe they’ll help me one day. Empathy and humanity survive all environments of high/low interest rates, remote vs in-person work, and technology trends, despite how it can feel in the current Vibecession. Some things change and some things stay the same.